Ukrainian banks owned by foreign financial groups make up an important component of the macro-financial and economic health of the country, an indicator for other foreign investors on whether to bring their money to Ukraine. Many banks with foreign capital have already emerged from the crisis of 2014-2015, demonstrating stability and profit, and some even have become a model of doing business in the banking market for the rest of the country's financial institutions. But at the same time, a number of foreign banks – and not only Russian state banks make up a problem for the banking sector. "Apostrophe" thoroughly investigated the peculiarities of banks with foreign capital in Ukraine.

In Ukraine, after the severe crisis of 2014-2015, relative stability in the financial sector was established. This is largely due to the National Bank of Ukraine (NBU). In recent years, the regulator has carried out the so-called "cleansing" of the banking system, which, despite the ambiguity, was generally positive.

Among domestic financial institutions, many of the banks owned by foreign banking groups demonstrate particular stability. But there are also leaders and outsiders, if we talk about the effectiveness of banks. Some of them have seriously supported the domestic economy in difficult years, not giving the crisis to stop the banking system. But many foreign banks have not been able to find their niche in our banking market due to weak management or unsuccessful business model. A separate problem was created by the Russian state-owned banks under international and Ukrainian sanctions - they have no future in our country.

Leaders and outsiders

As of July 1, 2019, there were 76 banks in Ukraine, 22 of which belong to foreign banking groups.

Three of them – “Sberbank”, “Prominvestbank” and “VTB Bank” are under the state control of Russia. They are subject to sanctions and are looking for ways to leave the Ukrainian market.

PJSC "Ukrsotsbank" is in the process of merging with PJSC "Alfa-Bank", and PJSC "VTB Bank" has a certain specificity of development, which, to some extent, separates it from other financial institutions.

Thus, today it is realistic to talk about 17 banks with 100% foreign capital.

According to the analyst of the investment company "Alpari" Maksym Parkhomenko, today, in general, we can say that "each of them has a specific role - working with companies or the public", - the expert in the comment to "Apostrophe" said. But to form a holistic vision, it is necessary to consider separately several indicators of their activities.

If we talk about the volume of profit, the leaders are: JSC "Raiffeisen Bank Aval", "UkrSibbank" and OTP Bank. In the period from 2014 to 2018 "Credit Agricole Bank", "Citibank", "ProCredit Bank" "ING Bank Ukraine", "Kredobank", "SEB Corporate Bank", "Creditwestbank" and "Deutsche Bank DBU" were constantly profitable.

Losers among banks with foreign capital and outsiders in terms of profit after tax included "Bank Forward" and "PRAVEX-Bank". At the same time, the results of the activities of "PRAVEX-Bank", which has remained unprofitable over the past five years, are particularly "impressive". Moreover, "PRAVEX-Bank" was the only bank with 100% European capital that showed such a chronic loss.

Profit after tax, thousand UAH

The data of the NBU

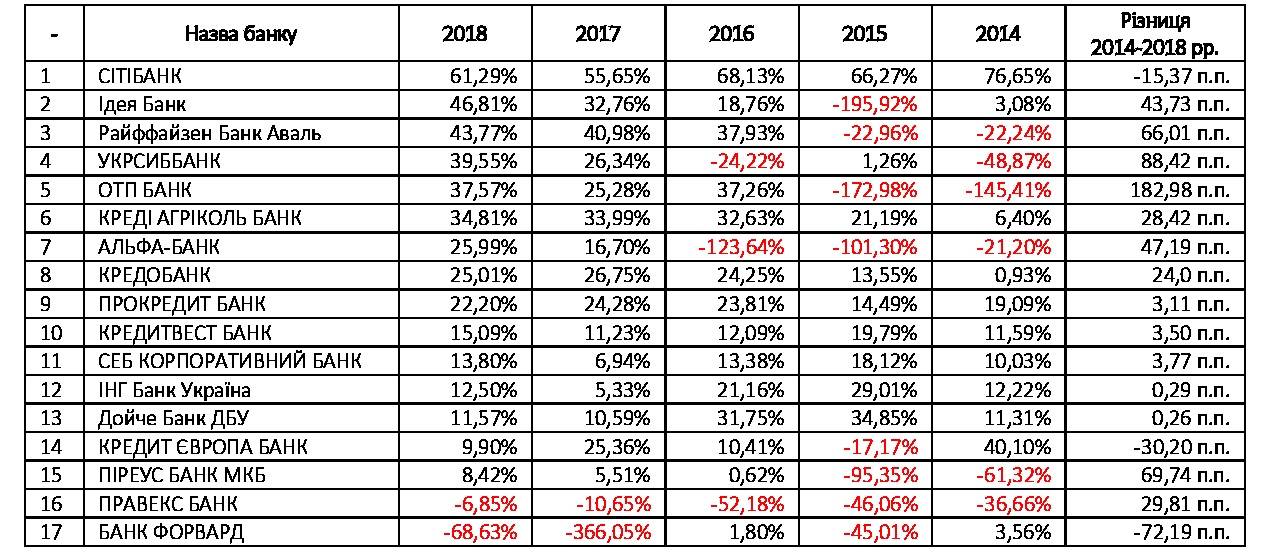

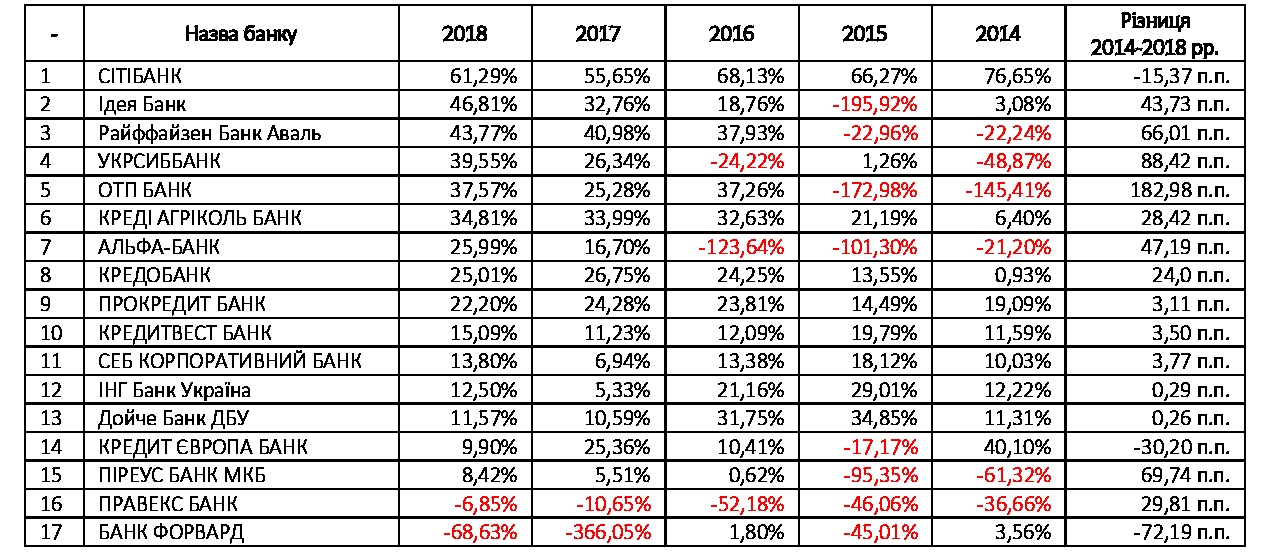

In terms of return on equity (ROE), "PRAVEX-Bank", as well as Citibank and Idea Bank are again among the leaders. Outsiders include "Bank Forward", which three years out of five showed unprofitability, and absolute "anti-record" - "PRAVEX-Bank", which all 5 years consistently demonstrates losses and unprofitability. At the same time, they were the only ones that showed negative profitability at the end of 2018.

Profitability of own capital, thousand UAH.

Calculations based on the NBU data on the grouped balance sheet balances as the ratio of profit after tax for the year to the bank's equity at the end of the year.

It's complicated.

With such an indicator as the return on authorized capital – that is, the return on invested capital – it is difficult for foreign banks.

The most effective banks for their shareholders in 2018 included: "Citibank" (+704%), "Credit Agricole Bank" (+119.6%) and “Idea Bank” (+112.56%). That is, in simple words, the shareholder, for example, Ukrainian "Citibank" for 2018 for every UAH 100 invested in the authorized capital of the bank, received UAH 704 profit after tax.

Outsiders of the ranking on this indicator in 2018 included "Bank Forward" and "PRAVEX-Bank". But at the same time "PRAVEX" showed chronic loss on the invested capital during all 5 years.

Return on equity, %.

Calculations based on the NBU data on the grouped balance sheet balances as the ratio of profit after tax for the year to the bank's equity at the end of the year

According to Maksym Parkhomenko from “Alpari”, the problems of PJSC “Bank Forward” and PJSC “PRAVEX-Bank” were often previously associated with the capital of financial institutions and their insufficiency, which is formed due to the revaluation of loan portfolios after 2014 and the growth of the dollar during this period.

In turn, the financial expert Vitalii Shapran in conversation with "Apostrophe" noted that for the majority of the Ukrainian banks with foreign capital, except, just PJSC "Bank Forward" and PJSC "PRAVEX-Bank", "very strong operating model" is characteristic.

"Such banks as "Raiffeisen Bank Aval" and "Credit Agricole" earlier came out of the crisis and for the second they are profitable, "Alfa-Bank" later returned to profitable work due to the fact that it is actively engaged in the acquisition of "Ukrsotsbank," he said.

At the same time, “Citibank” and “ING Bank” can generally give a master class on how to conduct business in Ukraine.

"Their business models are so strong that they did not notice the crisis," Shapran said.

Model to build

However, the "ING Bank" was not able to achieve the result of “Citibank” in terms of profitability of the share capital, in spite of the fact that the financial institution in its approaches to business in Ukraine seems to be just for “Citibank”. The business model, figuratively speaking, of "one office" in Ukraine and specialization in servicing corporate clients has always given good and even record results to foreigners. But when the market starts to grow, when people's incomes begin to increase, then banks with classic universal business models return to profitability. Such conclusions can be made based on the analysis of banks with large networks, such as “Raiffeisen Bank Aval”, “UkrSibbank” and “Alfa-Bank”.

At the same time, a certain dependence of profitability on the specialization or business model of the bank is not a guarantee. Thus, "Bank Forward" had low efficiency due to its specialization in lending to individuals and changes in the rules of accounting for loans and reserves on credit operations.

"Forward" is rather a victim of changes in accounting policy. The bank has almost 100% of loans issued to individuals, there is quite a large return on the portfolio," Vitalii Shapran said.

But PRAVEX, most likely, has problems with the business model, and, more precisely, with errors at the level of management in the management of changes in the unsuccessful business model, which is somewhat delayed – and quite seriously. Five years in a row of losses and no progress towards improvement – experts joke it must be not so easy to do.

According to the "PRAVEX-Bank", during 2013-2018, it received a loss of 2,724 billion. And in 2017-2018, when almost all banks with foreign capital returned to profitable work, the situation in this financial institution has not changed. Due to the management errors of “PRAVEX Bank”, the loan portfolio was significantly reduced, and one of the most extensive branch networks, which “PRAVEX” was once famous for, significantly decreased.

Thus, as of January 1, 2019, about 56% of the bank's assets were in deposit certificates of the National Bank, bonds of internal state loan, as well as in cash and correspondent accounts with the NBU. For 2018, “PRAVEX-Bank” tried to increase credit activity, but could do it only for UAH 672 million. At the beginning of this year, the Bank's net loans amounted to only UAH 1.2 billion– less than $ 50 million, a ridiculous amount even for a small regional bank, equal to the cost of investment in one average development project in the capital.

According to the parent structure of PRAVEX, the Italian group Intesa Sanpaolo, at the beginning of 2019 the bank's network consisted of only 46 branches (as of March 3, 2019 there were already 45). At the beginning of 2013, the network consisted of 260 branches. Thus, the usefulness of an extensive network of branches and branches, as well as its potential impact on the speed of credit expansion in a competitive market in the post-crisis period, was clearly underestimated. As a result, despite the possibility of lending to small and medium-sized businesses, as well as the population, without a significant network of offices it is impossible to do.

High interest rates on government bonds and certificates of deposits helped not much as evidenced by the low amount of the net loans. At the beginning of 2019, the parent Bank of “PRAVEX” estimated its book value at 61 million euros, which was about UAH 2 billion.

But in general, if we assess the situation with domestic banks with foreign capital, it is still quite positive. This is an encouraging signal for foreign investors. Unless of course we take into account the above individual examples.